How Your Credit Limit is Determined

You’ve made the decision to apply for a credit card. You go through the application process and a few weeks later receive a letter in the mail congratulating you on your new credit card. Along with your credit card, you’ll receive additional disclosures.

As new cardholder, it’s important to carefully review your agreement to fully understand the responsibilities and terms of your credit card. Your agreement spells out the associated potential costs of using your credit card. An example of a disclosure that may lead to potential costs is your credit limit.

What is a Credit Limit and Why Does It Matter?

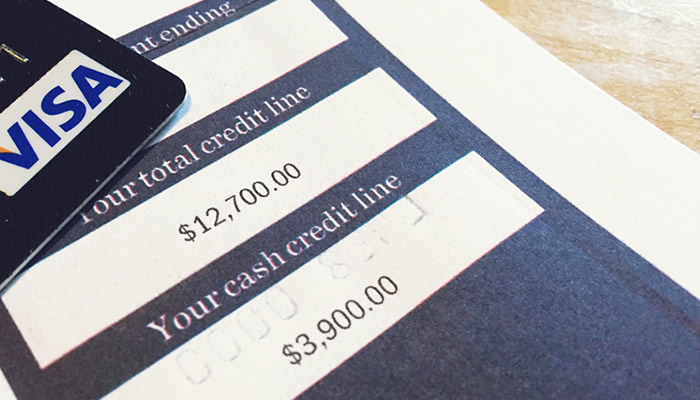

Your credit limit is your maximum spending limit within your 30-day statement period. When you first receive your credit card it comes with an initial credit limit. To better understand why credit cards come with credit limits, you first need to understand how credit card debt works.

Similar to a line of credit, your credit card is an example of revolving credit. With revolving credit, your credit card issuer lets you continuously borrow money up to a set dollar amount (your credit limit). It’s important to know your credit limit ahead of time. If you exceed your credit limit your credit card may be declined and you could face costly penalty charges.

What is Your Credit Limit Based On

Your credit card limit is based on the results of a statistical model that considers your credit score, length of credit history, rate of application for other forms of credit, income, debt, and more. Although the ways credit card issuers set credit limits may slightly differ, your credit score still plays a key role.

If you have a high credit score – typically 670 and higher – it indicates you have a history of paying your bills on time and represent a lower risk of default to the issuer. In exchange for a higher credit score, the issuer will provide you with a higher spending limit.

If you have a less favourable credit score (anything below 670), it indicates you may have a history of paying your bills late and being turned down for credit. Although you may still be approved for a credit card, you’ll typically receive a lower credit limit, as you represent a higher default risk to the issuer.

What Your Credit Limit Means for Your Credit Score

Even if your credit limit is less than you had hoped, it can still have a positive impact on your credit score. Your credit score is positively affected when more credit is available to you, as long as you use it responsibly – that means monitoring your account balance and keeping it far below your credit limit.

Ideally, you should aim keep your credit utilization below 35 per cent of your available credit. For example, if your credit limit is $5,000, you should strive to keep your account balance below $1,750 at all times. If you max out your credit card and other forms of credit it will have a negative impact on your credit score.

Low Credit Limits are Still Beneficial

If you have little to no credit history, typically you’ll start with a low credit limit. The good news is a low credit limit can still be beneficial. If you carry a small balance each month and pay it off in full, it can boost your credit score and eventually lead to a credit limit increase.

If you have a high credit score, sometimes you’ll receive a credit limit higher than you had hoped. Just because you receive a higher credit limit, doesn’t mean you have to accept it. You should only accept a credit limit you feel comfortable with. Lowering your credit limit is as easy as a phone call to your issuer.

Requesting a Credit Limit Increase

If you’re looking to pay for a major expense like home renovations or a new appliance, a credit limit increase can make sense. Credit limit increases can be made conveniently by phone or online. If you’ve been a cardholder for over a year, and always pay your credit card balance in full, you’ll have a better chance of being approved. It’s a good idea to apply for a credit limit increase well in advance, as it can take a few days – or weeks – to be approved.