Tangerine Card Changes Coming (and why you should read your mail)

Posted April 12, 2017 in Credit Card Tips, News

After another exhausting workweek, I was recently going through my mail. I’m used to receiving so many unsolicited offers from banks, so when I saw a letter from Tangerine, I assumed it was another special offer I wasn’t interested in, so I almost tossed it in the recycling without reading it. I’m glad I came to my senses and took the time to review the letter because as I soon discovered, it contained important information about changes to the Tangerine Money-Back Credit Card.

The Tangerine Money-Back Credit Card Devalued

It’s no secret we’re big fans of the Tangerine Money-Back Credit Card. In fact, we wrote a glowing review when it came out last year. 2 percent cash-back on up to three spending categories paid monthly – it doesn’t get any better than that! At first glance the credit card seemed too good to be true. Those initial fears appear to be warranted.

Tangerine used to be a bank that prided itself by not advertising teaser rates, but that’s slowly changed over the years. When I opened the letter from Tangerine, instead of a special offer, it was a notice about changes to my beloved Tangerine Money-Back Credit Card.

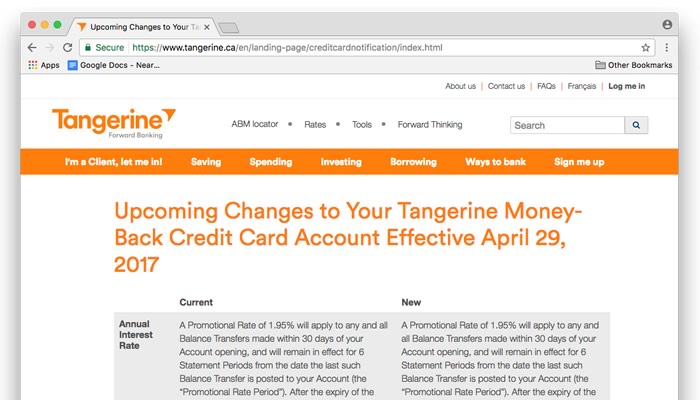

There are a number of significant changes coming into effect April 29, 2017 cardholders should be aware of. Among them, instead of 1 percent cash-back on all other purchases, you’ll only earn 0.5 percent. The foreign conversation/transaction fee is also being upped from 1.5 percent to 2.5 percent.

With significant changes like this to Tangerine’s Money-Back Credit Card, it’s the perfect time to shop around and see if there’s a better credit card out there for you. 2 percent cash-back is still great on the three spending categories of your choosing, but 0.5 percent on everything else isn’t. It’s not hard to find a cash-back credit card that offers 1 percent on all other purchases. My suggestion is to still use your Tangerine Money-Back Credit Card for the three spending categories and use another credit card in your wallet for everything else.

Don’t Toss Out Your Credit Card Notices

This just goes to show you the importance of reviewing every single credit card notice you receive in the mail or electronically. We’re bombarded with junk mail and spam these days, so it’s easy to miss something important.

This reminds me a lot of the Air Miles situation. Many years ago Air Miles quietly made an announcement about an expiry policy. Since there isn’t any requirement, Air Miles didn’t send any reminder notices after that. Air Miles parent company Loyalty One was hoping that it could quietly clear the miles of thousands of credit cardholders. Luckily that didn’t happen, but it should still serve as a reminder.

The Bottom Line

It’s easy for an email to end up in your spam folder, so for important notices like these, it might be a good idea to request to receive them by mail. When you receive a letter in the mail, don’t just assume it’s junk mail. Take the time to review it. Ignorance is not an excuse. The last thing you want is to toss out a letter with important information that affects your finances.